Trying to meet the UK tax deadline in January 2023? Here’s what to do

With the Jan. 31 deadline for filing tax returns in the United Kingdom fast approaching, crypto investors who haven’t yet submitted their crypto tax returns are in a tight spot. From figuring out how crypto is taxed in the U.K. to accurately computing net tax liability, it can be a perplexing and complex process for new investors.

However, by following simple registration steps and using advanced crypto tax tools, U.K. crypto investors can save a lot of hassle and file their tax returns online to avoid any late submission penalties.

Registering with the HMRC

In order to be eligible to fill out self-assessment tax returns online, crypto investors will have to first register with HM Revenue and Customs (HMRC), the non-ministerial department of the U.K. government tasked with the responsibility of collecting taxes.

Self-employed individuals or sole traders need to register through their business tax account online, while those who aren’t self-employed need to use form SA1 and fill it out online. Once done, investors will need to extract and keep records on hand to compute and fill tax returns correctly.

Calculating crypto income, expenses, and capital gains or losses

Before proceeding to file their self-assessment crypto tax returns, investors ought to understand how HMRC treats different types of crypto products and income in terms of taxation. While airdrops, liquidity pool rewards, mining, and staking income are taxable, cashback rewards, swaps, hard forks, and tokens from initial coin offerings tokens aren’t subject to tax.

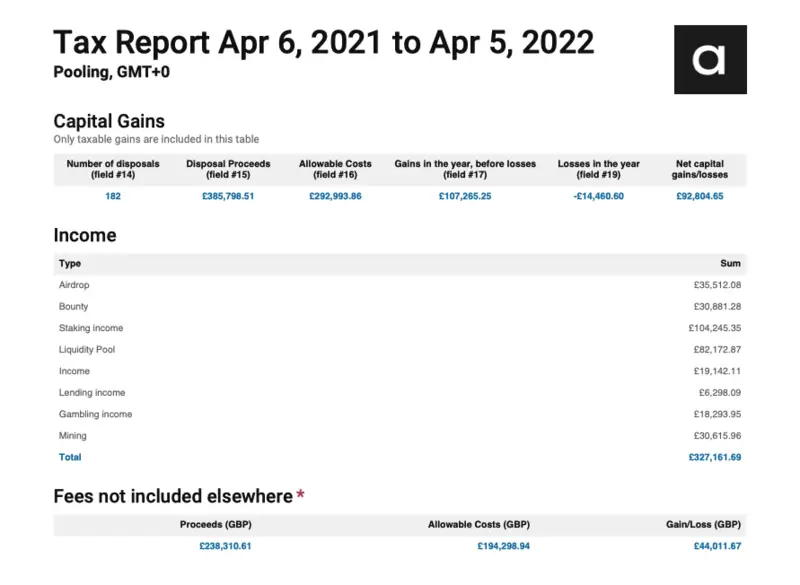

Investors will have to pore over their bank and trading account statements to arrive at the total crypto income earned through different segments and maintain expense data for each separately. Any capital gains or losses made in the accounting year will also be needed to arrive at the final tax liability. The cost basis for taxable disposals is calculated using HMRC’s pooling method, which allows for simpler capital gains tax calculations.

Filling out self-assessment tax return forms SA100 and SA108

Investors will then have to complete forms SA100 and SA108, following specific directions for each in order to report the net crypto taxable income and capital gains, if any. In box 17 of Form SA100, any crypto-taxable income such as staking, taxable airdrops, mining income or any type of yield needs to be reported, while compiling all expenses attributable to the income in box 18.

Additionally, any capital gains in excess of £12,300 need to be marked in box 7 and further reported using Form SA108, where details such as the number of disposals, total disposal proceeds and total allowable costs are needed in order to compute total gains, capital losses and net capital gain or loss applicable.

In the event that capital losses are being carried over from the previous year and being used in the current year, the same information needs to be updated in box numbers 45, 46 and 47 of Form SA108. The final Capital Gains Summary SA108 form can then be submitted using an online tax tool such as Taxd, which helps crypto investors easily process their self-assessment forms and directly submit them to HMRC online.

Here’s how to file crypto tax returns in five steps:

- Register with HMRC to file taxes online.

- Calculate crypto tax income, expenses and capital gains.

- Fill out the Self-Assessment Tax Return Form SA100.

- Fill out Form SA108 in case of crypto capital gains or losses being carried forward.

- Submit the Self-Assessment Tax Return form online by Jan. 31, 2023.

Using an online tool

While there are plenty of online crypto tax calculators, Accointing’s comprehensive crypto tax calculator stands out for not only automatically classifying income from sources such as cryptocurrency trading, mining, margin trading or even DeFi staking, but also calculating the net crypto tax applicable after adjusting for any tax loss harvesting. Moreover, users can use Accointing’s crypto tax reports on the Taxd platform to process their self-assessment forms with HMRC directly online.

What’s more, Accointing provides portfolio tracking solutions that can help investors review their crypto holdings and make informed tax-saving choices in the future. In terms of its compliance solution, Accointing’s users can directly import data from wallets and get an accurate tax report in a matter of five clicks. With more than 400 exchange integrations and partnerships with platforms like Taxd, Accointing offers crypto investors a one-stop solution for every need.

For users within the U.K., Accointing is offering a 20% discount on all of its plans, valid until Feb. 1, 2023.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Comments

Post a Comment