Avalanche (AVAX) Price Prediction: Will AVAX reach $30 in 2023?

Avalanche Blockchain is a layer one blockchain and is considered one of the most cost-effective and eco-friendly blockchains in the crypto and blockchain industry. AVAX is the native token of the Avalanche blockchain. AVAX can be used as a utility token within the Avalanche ecosystem.

As one of the top-rated altcoins, AVAX investors are still bullish on the token. Moreover, AVAX hodlers and stakers could receive gains and rewards over time.

If you are interested in the future of Avalanche (AVAX) and would want to know the price analysis and price prediction of AVAX for 2023, 2024, 2025, 2026, and up to 2050, keep reading this CoinEdition article.

Avalanche(AVAX) Market Overview

| Name | Avalanche |

| Symbol | avax |

| Rank | #17 |

| Price | $17.63 |

| Price Change (1h) | -0.24773 % |

| Price Change (24h) | 0.37996 % |

| Price Change (7d) | -0.50464 % |

| Market Cap | $5753575560 |

| All Time High | $144.96 |

| All Time Low | $2.8 |

| Circulating Supply | 326136844.689 avax |

| Total Supply | 422199472.502 avax |

What is Avalanche (AVAX)?

Avalanche (AVAX) was launched by Ava Labs in 2020, founded by Emin Gün Sirer, Kevin Sekniqi, and Maofan “Ted” Yin. Avalanche acts as a platform for decentralized applications and custom blockchain networks and is considered Ethereum’s rival.

The Avalanche platform is built on three chains which are X-Chain, P-Chain, and C-Chain. The X stands for exchange, P stands for the platform, and C stands for the contract. The C-Chain is controlled by the Snowman protocol that hosts transactions on the Avalanche blockchain.

The Avalanche native token, AVAX, can be used to perform the following activities within the Avalanche blockchain which are: payment of gas fees, payment of staking rewards to investors for supporting the consensus mechanism of the platform, and for the deployment of its multiple subnets that are used by validators.

At the time of writing, there is a total of 55 subnets, with total validators of 1220. Moreover, there are 262,258,406 AVAX in the platform as the total stake amount. Avalanche’s subnet stats also reveal that there were 49,516 active addresses and the average Transaction Per Second (TPS) for subnets is 23.04.

Decentralized applications (Dapps) and decentralized finance (DEFI) contracts are supported within the Avalanche blockchain. Transactions are completed instantly on the Avalanche blockchain since it can complete thousands of transactions per second.

Furthermore, there are many projects being built on the Avalanche ecosystem, which could continue to drive AVAX’s price upward over time.

Analyst View on Avalanche (AVAX)

Recently, Patrick O’Grady, the head of engineering of Ava Labs, reported that Avalanche‘s Cortina upgrade is live on the Fuji Testnet. This would pave the path for much broader adoption of the X-Chain, enhancing the UX of staking on the P-Chain and allowing complex transactions to take place on the C-Chain.

Moreover, Avalanche has recently introduced the Avalanche Evergreen Subnets. As described by Avalanche, it is a suite of institutional blockchain deployments and tooling, designed to address company-specific and industry-wide considerations. The Evergreen Subnets maintain the benefits of public network development while maintaining the features required for enterprise solutions.

Along with future developments, upcoming projects, and network, AVAX value could rise up in the coming future.

Avalanche (AVAX) Current Market Status

Avalanche’s native token, AVAX, is currently priced at $17.93 while experiencing a surge of 2.96% in seven days, at the time of writing. AVAX’s market cap is valued at $5,850,516,004, after witnessing a spike of 0.89% in just 24 hours. Moreover, there is a circulating supply of 326,127,566 AVAX while the maximum supply remains to be 720,000,000 AVAX. However, with a trading volume of $171,115,367, there is a fall of 6.84% in just 24 hours. This decrease in trading volume could indicate that the demand for AVAX is settling down. Although it may seem the demand for AVAX is reducing, Avalanche’s native token showed an exceptional performance over 30 days and witnessed a spike of 12.83% in 30 days, at the reported time.

Some of the top cryptocurrencies for trading Avalanche (AVAX) are Binance, Coinbase Exchange, Kucoin, Kraken, and others.

Now that you have known what Avalanche is and what its current market status is, let’s understand the price analysis of AVAX for 2023.

Avalanche (AVAX) Price Analysis 2023

Currently, Avalanche (AVAX) is ranked in the 16th position on CoinMarketCap. Will the upcoming projects on the Avalanche network increase AVAX’s price? Let’s find out in this Coin Edition price prediction article.

Avalanche (AVAX) Price Analysis – Bollinger Bands

The Bollinger Bands is a technical analysis tool that is used to analyze price movement and volatility. Bollinger Bands (BB) utilizes the time period and the stand deviation of the price. Normally, the default value of BB’s period is set at 20. The Bollinger Bands consists of upper and lower bands which can be used together, along with the middle line(simple moving average), to determine whether the price would rise or fall.

The upper band of the BB is calculated by adding 2 times the standard deviations to the middle line, while the lower band is calculated by subtracting 2 times the standard deviation from the middle line. Based on the empirical law of standard deviation, 95% of the data sets will fall within the two standard deviations of the mean. As such, the prices of the cryptocurrency, when the Bollinger bands are applied should stay within the upper and lower bands 95% of the time is the concept behind this.

Looking at the chart, AVAX is currently trading in the upper half of the Bollinger Bands, indicating that it is currently witnessing a bullish trend. Moreover, AVAX’s candlesticks have touched the upper band of the indicator, which could be considered a signal that the price could fall soon.

Furthermore, the Bollinger Bands are quite narrow compared to their past momentum. This could indicate that the price could remain same for some time as the the rate of volatility is predicted as low. Therefore, traders should observe the bands movement and observe the volatility rate before making a trade with AVAX.

Avalanche (AVAX) Price Analysis – Relative Strength Index(RSI)

The Relative Strength Index (RSI) is a momentum indicator utilized to find out the current trend of the price movement and determine if it is in the oversold or overbought region. Traders often use this tool to make decisions about when to buy or sell the tokens. When the RSI is often valued below or at 30, it is considered an oversold region, and a price the correction could happen soon. Moreover, when the RSI is valued above or at 70, it is considered as the overbought region, and traders expect the price could fall soon.

AVAX’s chart reveals that the RSI is between the 70 and 50 regions, valued at 52.22. Moreover, the RSI is above the SMA indicating that it is a bullish trend. However, traders should note that over time the RSI could go below the SMA as it is pointed downwards. If RSI goes below the SMA, it could be considered a signal that the bear trend could start soon.

However, RSI could immediately reverse the trend, which is a similar behavior observed recently. The moment RSI went below the SMA, the indicator reversed the trend and immediately went above the SMA again. Traders should observe the RSI and be cautious for any similar trend reversals.

Avalanche (AVAX) Price Analysis – Moving Average

Looking at the chart, AVAX is fighting hard to stay on top of the 50 MA. Earlier, the candlesticks were trading in between the MA indicators, which is a sign of consolidation. Moreover, the 50 MA is above the 200 MA which is considered a bull run. However, traders should note that the gap between these indicators is reducing indicating the bull run could end soon.

If the indicators cross paths again, with the 50 MA going below the 200 MA, this could be considered a sign that the bearish trend will start soon.

Avalanche (AVAX) Price Analysis – Moving Average Convergence Divergence

The Moving Average Convergence Divergence (MACD) indicator can be used to identify potential price trends, momentums, and reversals in markets. MACD will simplify the reading of a moving average cross easier. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Moving Average) indicator from the short-term EMA. Normally, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Moreover, MACD is considered a lagging indicator as it cannot provide trade signals without any past price data.

Traders have reported that occasionally the Moving Average could create false signals about the price momentum, however, MACD plays an important role as it can confirm the trends and identify the potential reversals.

Furthermore, there are two methods through which traders can speculate the price’s momentum: the crossover method and the histogram method. In the crossover method, when the MACD line crosses above the signal line, the trend could change from a downtrend to a long trend. However, if MACD crosses below the signal line, this could indicate the start of a downtrend.

In the Histogram method, the bars above the signal line indicate an uptrend. Meanwhile, the Histogram bars below the signal line indicate a bearish trend.

Looking at the charts, the MACD indicator also confirms that AVAX is currently facing a bull run. This is proved as the MACD is above the signal line. However, the gap between the MACD and the signal line is narrow, indicating that the trend reversal could happen soon. Moreover, the histogram also confirms that currently AVAX is facing a bull run. However, if the histogram’s green candles are reduced and fall in the red region, then, the AVAX will fall under the influence of the bears.

Avalanche (AVAX) Price Prediction 2023

Initially, similar to many altcoins, AVAX faced a great fall, where the candlesticks was trading below the 50 MA and the 200 MA. The great fall of AVAX also increased the distance between the 200 MA and the 50 MA. In August, AVAX formed a recovery point where the candlestick was above 50 MA, starting from this point the distance between the indicators started to reduce. After forming two recovery points below the 200 MA indicator, AVAX’s candlesticks crossed the barrier. AVAX witnessed a bullish trend above the 200MA, however, it went below both indicators.

However, recent candlesticks reached beyond the 200MA indicator. If a recovery point is formed above the 200MA and the distance between the indicators widens, then, AVAX could experience a bullish trend for some time. There is still a chance that the price could fall below the 200MA, therefore, traders should be careful.

Avalanche (AVAX) Price Prediction – Support and Resistance Levels

Looking at the charts, AVAX was trading from $13.96 to $17.68. Moreover, AVAX recently touched the Support, however, started trading above the support zone. If AVAX continues to maintain this bullish trend, then, it could soon reach the Resistance 1 level and trade even beyond $30.59. If AVAX breaks the Resistance 1 level, then, it could also reach the Resistance 2 level($44.89) over time, which is considered bullish.

However, if AVAX faces a bearish trend over time, then, it could fall to the Support at $14.99. AVAX could trade even below the Support region at $10.39.

However, our price prediction for AVAX continues to be bullish with its continuous demands from traders and upcoming upgrades and developments within its network. Ultimately, AVAX could be trading at $30 by the end of 2023.

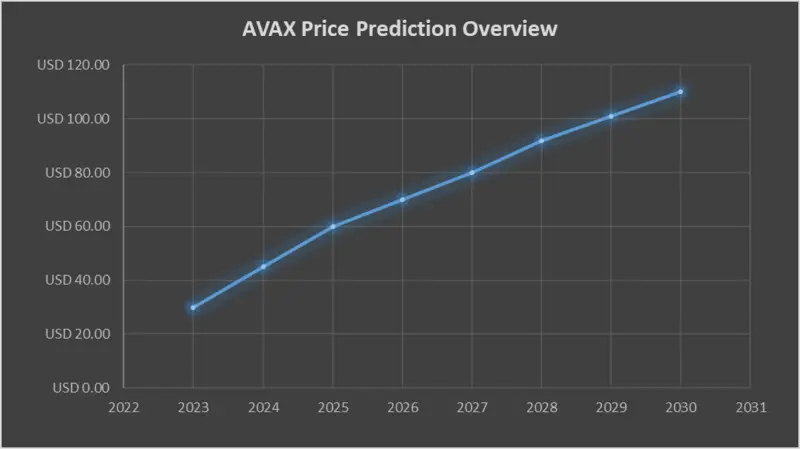

Avalanche(AVAX) Price Prediction 2023-2030 Overview

| Year | Expected Price |

| 2023 | USD 30.00 |

| 2024 | USD 45.00 |

| 2025 | USD 60.00 |

| 2026 | USD 70.00 |

| 2027 | USD 80.00 |

| 2028 | USD 92.00 |

| 2029 | USD 101.00 |

| 2030 | USD 110.00 |

| 2040 | USD 150.00 |

| 2050 | USD 200.00 |

Avalanche(AVAX) Price Prediction 2024

Traders are looking forward to this year as it could be a historic moment for cryptocurrencies, as the Bitcoin halving is expected to happen in 2024. Most of the time, whenever BTC rises, traders have observed a similar surge in the altcoins. AVAX could also be affected by Bitcoin halving and could trade beyond the price of $45 by the end of 2024.

Avalanche(AVAX) Price Prediction 2025

AVAX could still experience the after-effects of the Bitcoin halving and is expected to trade above its 2024 price. Many trade analysts speculate that BTC halving could create a huge impact on the crypto market. Moreover, similar to many altcoins, AVAX will continue to rise in 2025 forming new resistance levels. It is expected that AVAX would trade beyond the $60 level.

Avalanche(AVAX) Price Prediction 2026

It is expected that after a long period of bull run, the bears would come into power and start negatively impacting the cryptocurrencies. During this bearish sentiment, AVAX could tumble into its support regions. However, when AVAX remains in the oversold region, there could be a price correction soon. AVAX, by the end of 2026, could be trading beyond the $70 resistance level after experiencing the price correction.

Avalanche(AVAX) Price Prediction 2027

Naturally, traders expect a bullish market sentiment after the crypto industry was affected negatively by the bears’ claw. AVAX is expected to rise after its slumber in the bear season. Moreover, AVAX could even break more resistance levels as it continues to recover from the bearish run. Therefore, AVAX is expected to trade at $80 by the end of 2027.

Avalanche(AVAX) Price Prediction 2028

Once again, the crypto community is looking forward to this year as there will be a Bitcoin halving. Alike many altcoins, AVAX will continue to form new higher highs and is expected to move in an upward trajectory. Hence, AVAX would be trading at $92 after experiencing a massive surge by the end of 2028.

Avalanche(AVAX) Price Prediction 2029

2029 is expected to be another bull run due to the aftermath of the BTC halving. However, traders speculate that the crypto market would gradually become stable by this year. In tandem with the stable market sentiment and the slight price surge expected after the aftermath, AVAX could be trading at $101 by the end of 2029.

Avalanche(AVAX) Price Prediction 2030

After witnessing a bullish run in the market, AVAX and many altcoins would show signs of consolidation and might trade sideways for some time, while experiencing minor spikes. Therefore, by the end of 2030, AVAX could be trading at $110.

Avalanche(AVAX) Price Prediction 2040

The long-term forecast for AVAX indicates that this altcoin could reach a new all-time high(ATH). This would be one of the key moments as HODLERS may expect to sell some of their tokens at the ATH point. However, AVAX may face a slight fall before starting its upward journey once again. It is expected that the average price of AVAX could reach $150 by 2040.

Avalanche(AVAX) Price Prediction 2050

The community believes that there will be widespread adoption of cryptocurrencies, which could maintain gradual bullish gains. By the end of 2050, if the bullish momentum is maintained, AVAX could surpass the resistance level of $200.

FAQ

AVAX is the native token of the Avalanche blockchain. It is controlled by the Avalanche Foundation. It is one of the most cost-effective and eco-friendly blockchains in the crypto and blockchain industry.

AVAX can be traded on many exchanges like other digital assets. Binance, Coinbase Exchange, Kucoin, Kraken, and others. are some exchanges that trade AVAX.

AVAX has the potential to break its all-time high of $146.22 by 2040.

AVAX is one of the top-ranking tokens and if it manages to break above the present momentum, then, it has the potential to hit $100 by 2029.

Since AVAX has proved that investors are showing a huge demand, this altcoin has the potential to become one of the best investments in 2023. Moreover, its current trend could break the resistance levels forming new higher highs.

The lowest price of AVAX is $2.7888.

AVAX was launched in 2020.

AVAX can be stored in a hot wallet, cold wallet, or exchange wallet.

AVAX is expected to reach $30 by 2023.

AVAX is expected to reach $45 by 2024.

AVAX is expected to reach $60 by 2025.

AVAX is expected to trade beyond the $70 level.

AVAX is expected to reach $80 by 2027.

AVAX is expected to reach $92 in 2028.

AVAX is expected to reach $101 by 2029.

AVAX is expected to reach $110 by 2030.

AVAX is expected to reach $150 by 2040.

AVAX is expected to trade beyond the $200 resistance level.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

More Crypto Price Predictions:

- Stellar (XLM) Price Prediction: Will XLM reach $0.5 Soon?

- Cosmos (ATOM) Price Prediction: Will ATOM reach $40 Soon?

- Ethereum (ETH) Price Prediction: Will ETH reach $5000 Soon?

- Ethereum Classic (ETC) Price Prediction: Will ETC reach $70 Soon?

- Shiba Inu (SHIB) Price Prediction: Will SHIB reach $0.00005 Soon?

Comments

Post a Comment